Strivenn Thinking

Pull up a seat at our

digital campfire

where story, strategy,

and AI spark

new possibilities

for sharper brands

and smarter teams.

The Move That Matters Most

By Jasmine Gruia-Gray

Aligning Product Strategy with Competitive Reality

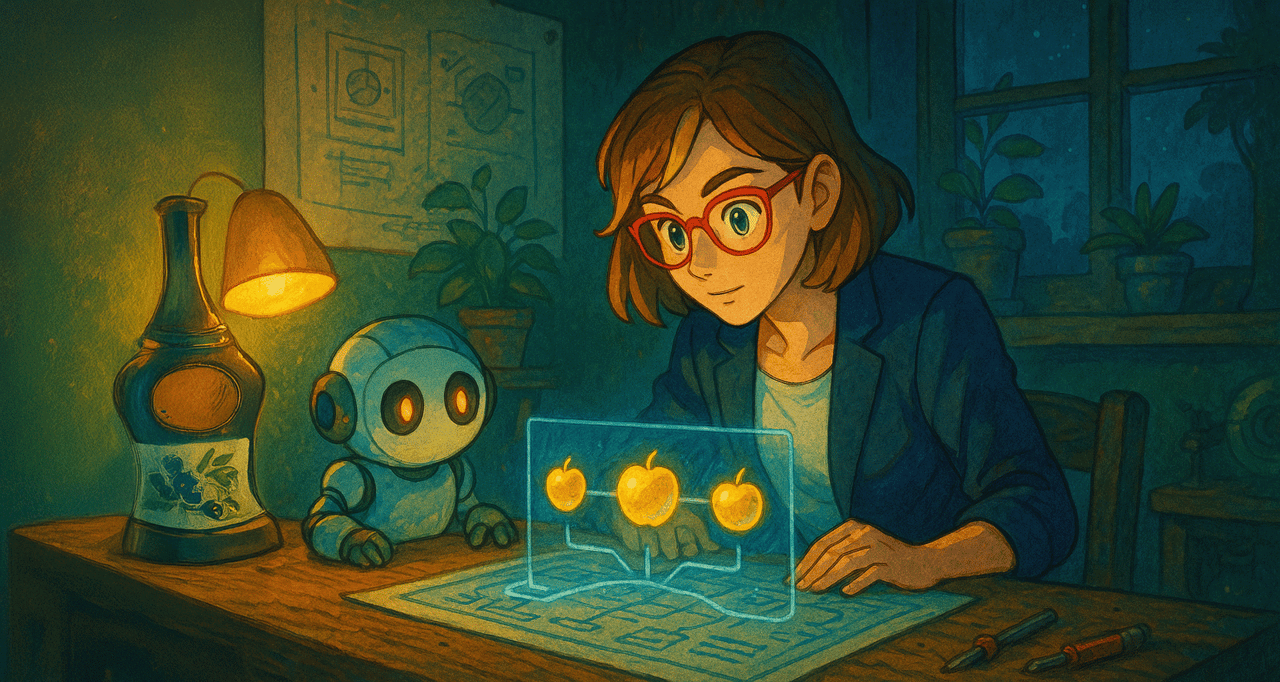

Atalanta was known across Greece for her unmatched speed. Suitors lined up to race her, but none could keep pace. Then came Hippomenes. Realizing he could never outrun her stride for stride, he tried a different approach. Armed with three golden apples from the goddess Aphrodite, he dropped them at carefully chosen points along the course. Each time, Atalanta paused to pick up an apple, giving him just enough of an edge to win.

It's a story that has less to do with raw speed and more to do with insight and timing. Hippomenes didn't try to outmuscle or outsprint Atalanta. He won by knowing where and when to act.

That lesson applies directly to product lifecycle management. A new launch can feel like a sprint, full of excitement and momentum. But as products mature, competitors enter the race, customers get distracted, and running faster isn't enough. Success depends on well-timed strategic moves, your "golden apples", that keep your product relevant and competitive across the lifecycle.

What Marketers Do First in a Head-to-Head Race

To explore this dynamic, I recently ran a LinkedIn poll asking: After you learn a rival is winning head-to-head, what's your first move?

The results were revealing. Forty-three percent said they would update their value narrative and claim, reframing how the product is positioned in the customer's mind. Another 43% leaned toward running a head-to-head application note or test, generating proof of performance in direct comparison. Interestingly, no one prioritized adjusting the commercial offer through bundles or free trials, while 14% suggested "other" approaches such as deeper comparison analysis or gathering customer feedback.

The near tie between narrative and proof shows the tension marketers face. Do you try to change the story customers are hearing, or do you produce hard data to back up your claims? The answer, of course, depends on timing and context. Just like Hippomenes, the art lies in knowing which apple to drop at which stage of the race.

Golden Apples Across the Product Lifecycle

Let's break this down through the lens of product lifecycle management: launch, growth, maturity, and decline. Each stage offers different opportunities for competitive analysis, and different types of golden apples to deploy.

1. Launch: Building Momentum

At launch, the temptation is to run as fast as possible, to flood the market with promotions, demos, and technical notes. But the smarter move is to first analyze the competitive landscape. Who else has launched recently? What claims are they making? Where are the customer pain point gaps in their narrative?

Your golden apple at this stage is often positioning. Rather than competing head-to-head on specs, you can win by framing your product in a way that matters more to your ideal customers. This is where updating your value narrative, as many poll respondents suggested, pays dividends.

List three competitor claims side-by-side with your own, then ask: where's the unclaimed territory? Prioritize the answers and make this part of your launch plan.

Example: A new instrument company may find its rivals touting "highest throughput" as their differentiator. Instead of chasing that claim, they can position around "confidence in every result", a value that resonates more deeply with translational researchers concerned about reproducibility.

2. Growth: Staying Ahead of Rivals

As sales climb, competitors start responding. They may lower prices, produce new application notes, or highlight head-to-head comparisons. This is where direct proof becomes your golden apple. Customers who are weighing alternatives want evidence. Head-to-head application notes, performance benchmarks, or peer-reviewed studies can anchor your narrative and prevent rivals from stealing momentum.

Talk with your sales and field application teams to learn the top three claims prospects mention. Use these ideas as part of your applications plan.

Example: A consumables provider sees its kits compared unfavorably against an incumbent. By working with a reference site, they can run experiments that highlight unique advantages, such as faster prep time, or cleaner signal. The scientists can also provide feedback on the type of personalized customer experience, and applications support received, which can help you maintain an edge.

3. Maturity: Extending Relevance

Eventually, the market slows. Competitors may match your features, and customers may see products as interchangeable. This is the stage where innovation in customer experience or bundled value becomes the golden apple.

Interestingly, none of the poll respondents prioritized adjusting offers through bundles or trials. But in maturity, these tactics often matter most. Bundling consumables with instruments, offering extended warranties, or building service partnerships can refresh relevance when technical differentiation is thin.

Example: A reagent provider nearing maturity introduced a subscription model for recurring shipments, locking in loyalty and smoothing revenue while competitors continued to fight over one-off purchases.

4. Decline: Knowing When to Pivot

All products eventually face decline. Here, the golden apple isn't about trying to outrun competitors, it's about deciding where to place your next bet. Competitive analysis can reveal adjacent opportunities: new customer segments, new geographies, or even the decision to sunset gracefully and reinvest in Horizon 2 or Horizon 3 innovations.

Example: A company phasing out an older imaging platform invests in targeted competitor analysis and discovers unmet needs in spatial biology workflows. Instead of squeezing more life out of the old system, they pivot resources to a growth market where competitors have yet to dominate.

Competition Analysis as Ongoing Advantage

The Atalanta story reminds us that the race isn't always about speed. It's about knowing where your rival's focus is and when they might pause. Competition analysis gives you that insight.

Closing Thoughts

Jay Acunzo said it best: "It's not about more marketing; it's about mattering more." Hippomenes didn't run harder than Atalanta, he mattered more in the moments that counted. For marketers, that means looking beyond brute-force tactics like bigger budgets or louder campaigns. It means using competition analysis to understand the race you're in, anticipate the moves of your rivals, and act with precision across the product lifecycle.

When you do, you'll find that the golden apples of strategy, timely positioning, compelling proof, smart bundling, or decisive pivots don't just help you keep pace. They make your product the one that matters most to customers, no matter where it sits in the lifecycle.

Where are you in the race right now: launch, growth, maturity, or decline? What golden apple are you dropping?

If you want help deciding which move matters most for your portfolio, Strivenn runs workshops on lifecycle strategy and competitive analysis.

Q. How do I know which "golden apple" to use at a given stage? ▼

A: Look for customer and competitor signals. At launch, if customers seem confused about why your product matters, or competitors are overemphasising specs, your cue is to sharpen positioning and value narrative. In growth, if prospects are comparing you head-to-head and sales teams keep asking for "proof points," it's time for comparative data or application notes. In maturity, if customers say products look interchangeable, a bundling or experience innovation can reset expectations. And in decline, if new entrants or technologies are pulling attention away, the signal is to stop sprinting and start pivoting.

Q: What tools or methods can I use for competition analysis? ▼

A:Start simple. Scan competitor websites for updated claims, watch product launches at conferences, and subscribe to their press releases. Talk to sales reps, they hear firsthand how customers compare you with others. For deeper insight, track published application notes, check citations in scientific papers, and use SEO tools to see what customers are searching. The key is consistency: make competition analysis an ongoing habit, not a once-a-year exercise. Strivenn can create a custom AI-tool to help you stay on top of competitor analysis and customer sentiment, please contact us.

Q: How do I apply this if my portfolio has multiple products at different stages? ▼

A: Your job is to allocate energy where it matters most. That might mean investing in proof for the growth-stage star while also planning a graceful exit or pivot for the product in decline. Align your golden apples with revenue contribution and strategic fit, don't throw them all at once across every product.